how are property taxes calculated in lee county florida

Receipts are then distributed to associated parties via formula. Assessed Value - Exemptions Taxable Value.

Volusia County Fl Property Tax Search And Records Propertyshark

A millage rate is one tenth of a.

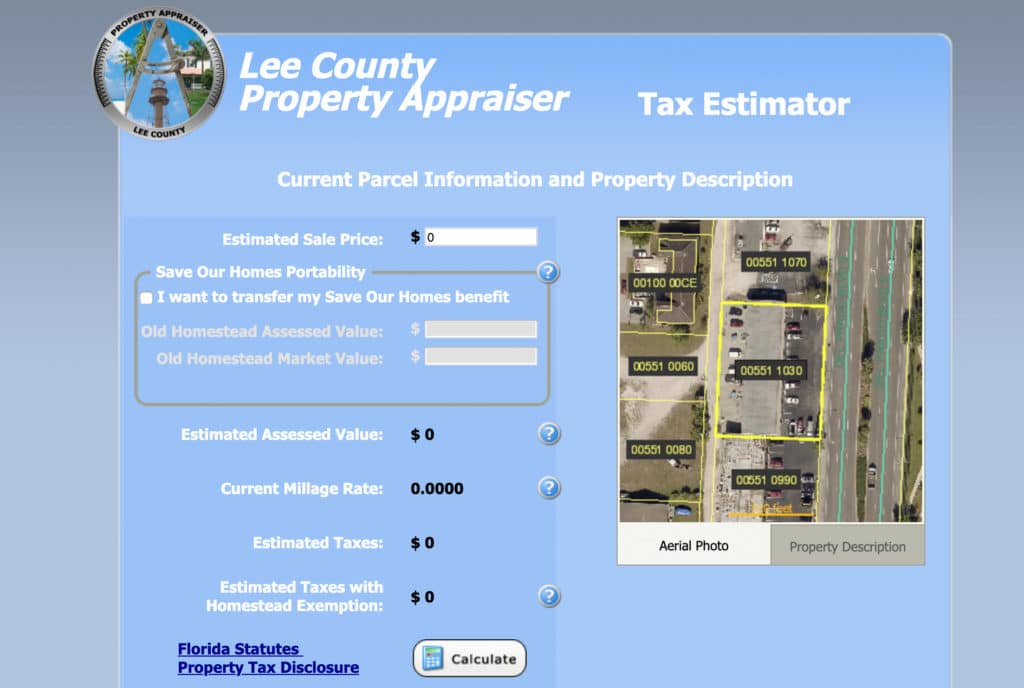

. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would. Our Lee County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden. Lee County calculates the property tax due based on the fair market value of the home or property in question as determined by the Lee County Property Tax Assessor.

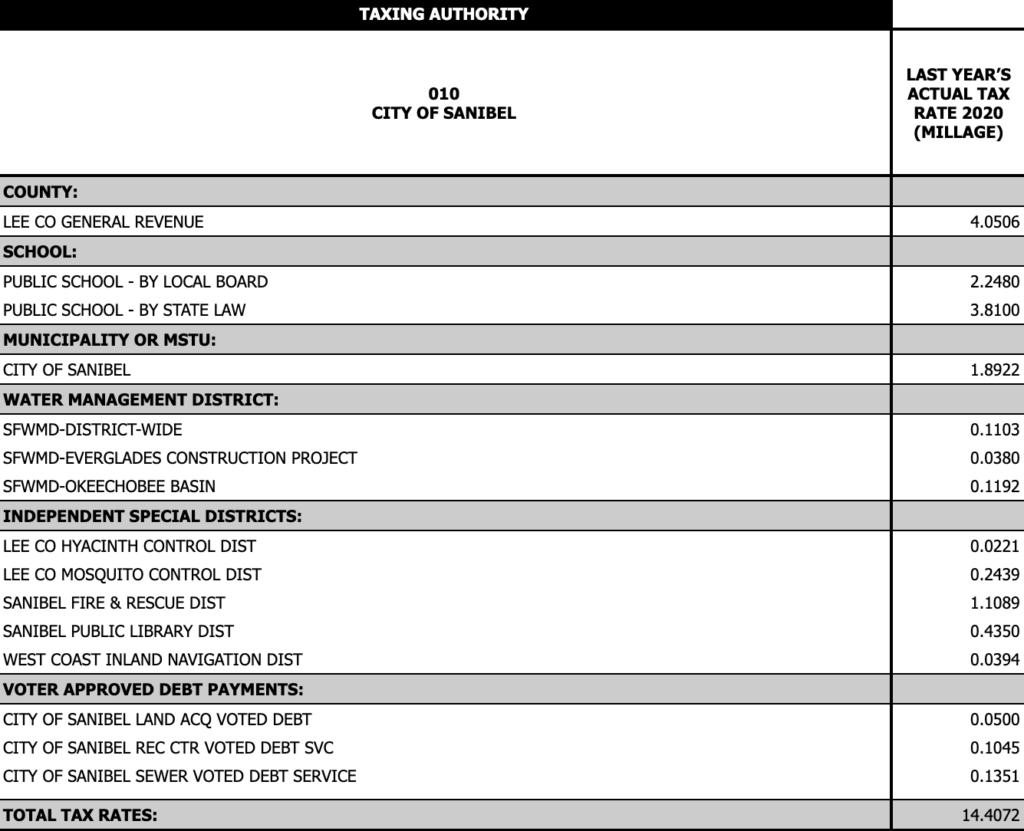

The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County. Just Value - Assessment Limits Assessed Value. Transfer taxes would come out to.

In Miami-Dade County your rate is 60 cents per 100. Ad valorem taxes are based on the value of. When it comes to real estate property taxes are almost always based on the value.

To view payoff information call. 370738100 x 60 222443. Calculate your real tax bill incorporating any tax exemptions that apply to your real estate.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. The median sale price in Miami is 370738. What Is Property Tax.

40 the value difference is 40. Find the assessed value of the property being taxed. Tax Deed and Foreclosure Sale Processes.

To calculate the property tax use the following steps. Ad Need Property Records For Properties In Lee County. 100000 this is the available portability amount Percentage.

Estimate My Lee County Property Tax. The median property tax also known as real estate tax in Lee County is based on a median home value of and a median effective property tax rate of 104 of. Search Public Property Records In Lee County By Address.

To pay back taxes and fees to cancel a sale please follow the instructions on the notice received from the Clerk. This simple equation illustrates how to calculate your property taxes. 1 be equal and uniform 2 be based on present market value 3 have a single estimated value and 4 be held taxable unless specially exempted.

Then question if the amount of the increase is worth the time and effort it requires to challenge the. Historically tax rates have fluctuated within a fairly. How Broward County property taxes are determined.

Taxation of real property must.

The Cost Of Buying And Owning A Property

Florida Property Taxes Explained

Florida Property Taxes Explained

Florida Property Taxes Explained

Property Tax By County Property Tax Calculator Rethority

Lee County Fl Property Tax Search And Records Propertyshark

Property Tax By County Property Tax Calculator Rethority

Florida Dept Of Revenue Property Tax Data Portal

Florida Property Tax H R Block

Property Taxes Calculating State Differences How To Pay

Property Tax By County Property Tax Calculator Rethority

Southwest Florida Real Estate Taxes Southwest Fl Dave Sage Brenda Boss Sagerealtor Com

Florida Property Taxes Explained

South Carolina Property Tax Calculator Smartasset

Property Taxes Calculating State Differences How To Pay

With Save Our Homes Homeowners Savings Are Governments Loss

Lee County Property Tax Getjerry Com

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One